As the Bank of England continues to increase the base rate, Vinay Rathod of VR Financial Solutions considers what this means for the conversations you have with your patients.

The insanity

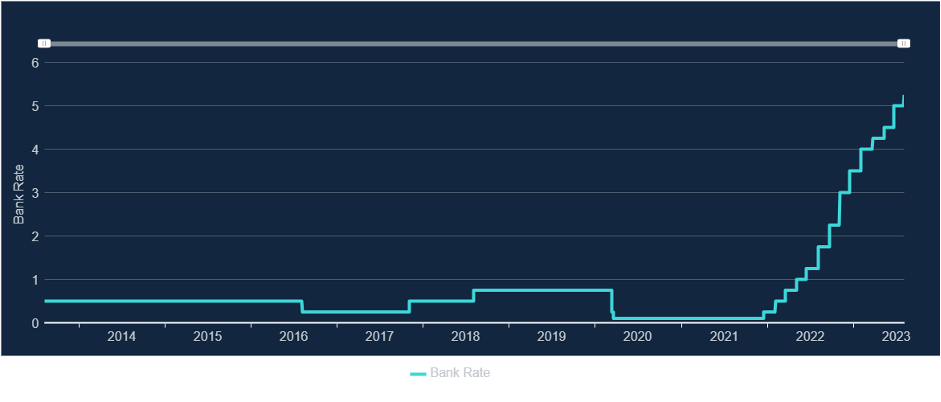

The bank of England increased the base rate again today (3 August 2023) to 5.25% – the 14th consecutive rise and an increase in 5% since late 2021.

Moneyfacts noted that the average two year fixed rate is 6.85% versus 2.34% from December 2021.

You may have read my earlier article which explained the disconnect between mortgage rates, and the bank of England base rate.

So why am I talking about the base rate today? Because of the knock on effect that has caused mortgage rates to rise to the highest we have seen in over 15 years.

Maximum mortgage sizes are now noticeably lower than they were previously due to the stress testing at higher interest rates, and cost of living increases being considered in the background by mortgage lenders.

Nearly 15 years of bargain basement interest rates have resulted in a generation of people spoiled by the availability of low cost borrowing, to fund lifestyles that many argue were never sustainable. Many people in today’s workforce have never known mortgage rates much above 2%.

Money has been cheap for a long time.

We live in a time where nobody saves – and thus nobody saved – for this terribly rainy day we see outside today. All we can do is watch and hope that the flood defences our government and the Bank of England’s monetary policy committee are erecting might keep the water from our front doors.

The impact

I wrote previously about how the changing economy and mortgage rates affect dentists. I want to talk today about how the changing economy will impact the conversations you have in clinic with your patients – and how the knock on impact could affect your pocket even more than rising mortgage rates directly do.

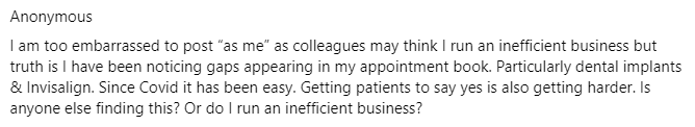

This question was posted on a dental business Facebook group and the common theme was that others were feeling the same… it was not because this dentist ran an ‘inefficient business’ at all, but because the public are afraid.

The Office for National Statistics’ (ONS) data shows that the monthly cost of a new mortgage rose by 61% in the year to December 2022 for the average semi detached house in the UK.

Numerous news publications are talking about the £500 a month the Bank of England has warned that one million people are going to face by 2026. If this is the average, we can surmise that a very large number of people will see larger rises than this.

The fallout

Because your patients don’t know how mortgages are priced, they don’t know how they are going to pay the huge increases they face on their mortgages at renewal time – on top of the already tremendously increased costs for gas, electric and most of the things on supermarket shelves. They begin to stop paying for the things they consider unnecessary or a luxury.

Largely, dentists will suffer the consequences of the current turmoil far better than their patients. Dentists will have less disposable income, less surplus to invest or enjoy. But few should have genuine concerns over whether they will be able to (fiscally) survive.

Your patients will, unfortunately, largely not fare so well. Many have already had to assess which direct debits they can cancel and what they can spend less on – and it was never easy to convince people to spend money on their teeth to begin with.

As the months pass and more are forced to move to much higher rates, you will find it more difficult to sell treatments that are not alleviating pain or interfering with function. Invisalign open days will not be as easily filled. Implants will not be so easy an alternative to offer. Aesthetic treatments will be more frequently compared with offers from unqualified beauty workers.

Those of you who have made hay during the sunshine we saw over the recent years – the years of abundant cashflow supplied by COVID-19 relief funds of various types, the lack of regular holidays and nights out, the spare cash many found themselves with as a result – will not so easily be separated from their hands any longer.

The response

For those who notice a downturn now or in the future, you can take comfort in knowing it will eventually recover, and you will not be in a bad place when it does – just keep your bills paid, money in the bank for a rainy day, and spend wisely.

For those who want to be proactive and try to counteract this downturn, you will have to be observant and willing to change your clinical approach.

I say this with great care as someone who has never practiced clinically, but I do know that communication is more important than clinical skill when convincing a patient that you are the right clinician for them – this is part one.

Part two is to let them sell the treatment to themselves, you have no control over the value they perceive. You must simply show them the better life they will live if they go ahead, and the improvements in the areas of their lives that matter to them the most – and something different matters most to everyone.

Your objective is to have them tell you this, then have them tell themselves why they should take your proposed plan forward.

With this approach they will figure out how to afford it – because they now want it, just as much as they want the holiday or the new car or clothes.

Read previous Mortgage Expert articles:

For more information, visit vrfs.uk.