Vinay Rathod explains the importance of income protection policies, and how to find the right one for you.

Income protection is a policy you will all have heard of, but less than 50% of dentists have in place. Many who have their cover set up incorrectly won’t know until they try to claim.

So what exactly is income protection, and how is it different from critical illness cover, or locum insurance?

It is arguably the most important income protection policy that you are not legally required to have in place.

Income protection:

- It provides a monthly income if you cannot work due to sickness, injury or indeed any medical reason

- There is no list of conditions that it does or does not cover. It only depends whether you have been deemed medically unable to work in your role as a dentist

- You do not pay tax on the income you receive if you claim

- You can typically insure around 60% of your income

- Cover can last until your planned retirement age with no maximum claim length

- There are no annual ‘renewals’ such as with locum cover, car or home insurance. Any claims made, or changes to your health after taking a plan out, will not impact the cover or price you pay. This is why it’s advised to take cover when young, fit and healthy

- Any exclusions are based on your existing medical history and will be stated before you accept the cover

- Can be linked to inflation so any claim is increased in line with inflation every year.

Critical illness cover:

- Has a specific list of conditions that it will cover, payment is made on diagnosis of those conditions only

- Is a lump sum payment not linked to your ability to work, with the exception of ‘total and permanent disability cover’ which requires permanent disability from working

- Will also pay if you are permanently disabled from working, in addition to covering the stated critical illnesses

Locum cover

Locum coverdiffers entirely from the above. It will pay for a maximum of 12 months, and you will receive an annual renewal quote. The renewal terms are impacted by previous claims and changes in your health since last renewing.

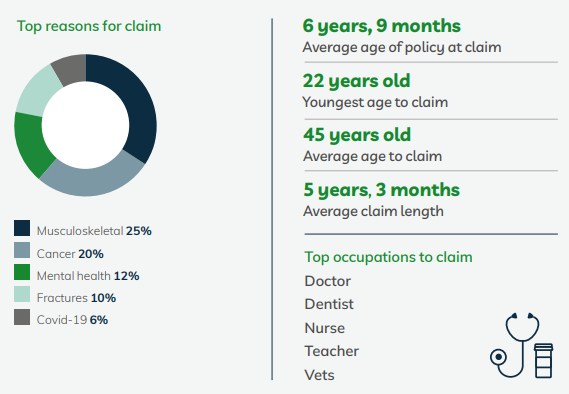

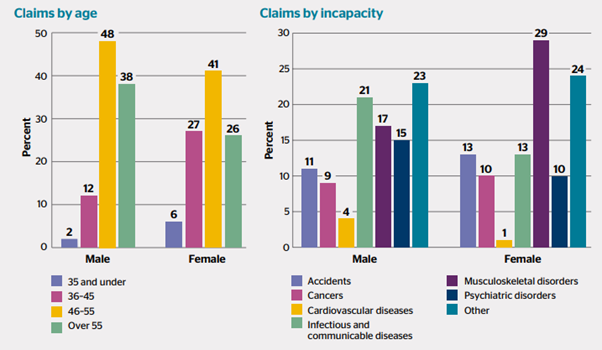

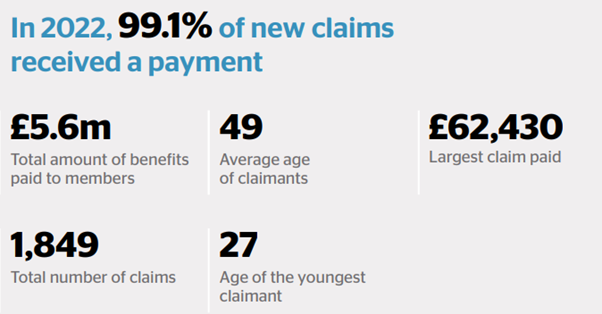

LV’s 2022 claims report shows dentists are amongst the highest claiming occupation – this is no surprise in a profession whose working posture and pressures often cause the problems that prevent working.

Dentists Provident’s 2022 claims report gives some more insight into the reasons for dentists claiming. Many may be surprised that most claims are made by people in their 40s. This is much younger than most would guess.

Why do dentists need specialist advice?

There are a number of things rather unique to dentistry:

- Self employed NHS associates uniquely are entitled to NHS sick pay. There are certain qualification criteria for entitlement to NHS sick pay. Entitlement differs between England & Wales, Scotland and Northern Ireland

- Salaried PAYE employees within the NHS have a sick pay entitlement that accrues annually over five years of service. You can’t receive both sick pay and full income protection benefits. So, it is very important to choose your deferred period correctly

- LTD company directors forfeit NHS sick pay (and other benefits) if they pay NHS income via the limited company

- Almost all insurers only recognise your salary and dividends and will not pay based on income retained within the business.

Choosing your deferred period:

‘Deferred period’ refers to how long you have to be unable to work before you can claim on the plan.

It is often overlooked that you cannot receive both the maximum income protection benefit and sick pay. Insurers can’t have you earning more while off sick than if you were at work.

But when you have both the NHS and private income (which has no sick pay entitlement), how is this accounted for?

How do you account for a changing sick pay allowance as you build your employment length with your NHS employer?

Choosing the level of cover:

Firstly, it’s important to know that ‘income’ does not necessarily refer to what you might call income.

For an employed dentist in a PAYE role, your gross salary (before tax) will be looked at.

For a self-employed dentist (sole trader or partnership) it will be the ‘net profit from self employment’ or ‘share of partnership profits’ from your SA302 tax calculation. This is usually an average from the last two years.

For a limited (LTD) company director, insurers will look at your salary and dividend, again, usually an average over two years. However, a very small number of insurers may look at your salary and entitlement of company profit. For example, if you own 50% then they will look at 50% of the company profit after corporation tax).

If you are unsure, simply call your insurer. Ask them what income they will recognise for a limited company director.

This is the most common area that is not well understood, not just in the dental sector, but worryingly in the financial sector also – many still believe all insurers will recognise a LTD company director’s salary and company profit.

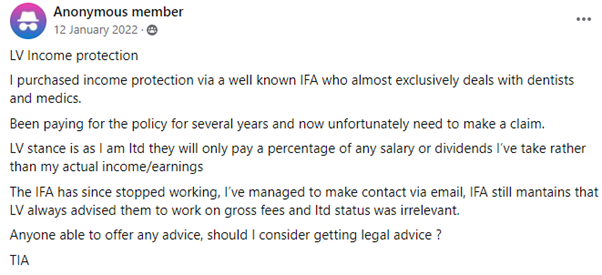

Sadly, this has been the case for a number of dentists, as can be seen by this post made on a dental facebook group seeking advice. The advisor in question had since declared bankruptcy and no longer worked, hence little recourse was available for this individual besides what the Financial Services Compensation Scheme (FSCS) deem appropriate.

It should be highlighted that LV do indeed only recognise salary and dividends for their income protection policy, and have clearly stated this on their documentation and, in my experience, via phone or email when asked.

Limited company profits that are retained

There are a small number of insurers who will recognise your salary and company profit (after corporation tax) relating to your shareholding – eg a 50% shareholder will be able to cover 50% of the company profits.

If you have a non-dentist spouse or relative as the other shareholder, their salary and allocated profit share can often be ‘added back in’ to your insurable value – this is not the case with all insurers and requires a good understanding of how each insurer differs.

Can my LTD company pay for my income protection?

This is a question often asked by directors of LTD Companies – the answer is technically yes, but in most cases, it is not recommended in practical terms.

Executive income protection is a relatively new product to the market – a policy that the company pays the premiums for, with no benefit in kind tax payable.

However it should be noted that the executive income protection plans that exist today will only cover a portion of your salary and drawn dividends. Further to this, as this is a policy owned for and paid for by the company, the benefits in the event of a claim are paid back to the company. You will pay tax to draw this money out in the same way as any other drawings from the company.

As such, the premium is not as attractive versus that of a personal protection plan as first may appear when considering the tax efficiency. For the majority of dentists who operate in a LTD company, covering only your salary and dividend is usually not a sufficient level of protection.

How much cover is appropriate for you?

This is the next important question – is the maximum necessary, or is enough to cover your bills sufficient?

It may be that you are able to manage comfortably on well below the maximum the insurer permits. Often, it’s tempting to pay less when you don’t need the cover.

There are some points to consider when deciding :

- Any pre-existing medical conditions will either be excluded from any more cover you add, or you might not be able to add more cover later. The most common chronic medical condition that prevents almost everyone getting income protection or critical illness cover is diabetes

- The older you are, the more the cover will cost for the lifetime of the plan. It is easily calculated to see that saving on one year of cover will be more than lost due to the cost increase of taking cover one year later. The older you get, the wider this gap becomes

- The amount of cover you choose will potentially have to support you until you reach your planned retirement age, with some provision for your life after this. You will not benefit from career progression, Invisalign open days, NHS pension contributions – thus, your chosen level of cover should be sufficient in the worst case scenario.

Premium type:

Guaranteed… Reviewable… Age banded… Guaranteed…

It is tempting to choose your cover based on cost.

The reviewable and age banded cover will always be priced lower, but the costs will rise.

However, the guaranteed cover provides the certainty of the most efficient cost over the life of the plan. Short-term cashflow is rarely the dentists main concern, but rather, long-term wealth creation.

Reviewable premiums are annually reviewed by the insurer and the costs will increase as the years go by. This is at the insurer’s discretion.

Age banded premiums are increased annually. They will usually show you the future premiums for the life of the plan on the quote. Note that the cost increases are larger the older you become.

Guaranteed premiums offer the certainty of not suffering from premium reviews, or scheduled increases in cost each year – the insurer will cost the price of your cover at application, for the entire life of the plan.

However, the monthly premium can still rise if you have selected indexation/inflation linked cover as you are charged for the addition of cover each year. The cost of the cover already in place will never increase with a guaranteed premium.

The long term

Most of you are paying premiums from a monthly surplus of income, not budgeting how far your income will stretch.

Saving money per month now, only to see a larger lifetime premium is counter to this objective.

In this example, we look at a 25-year-old non-smoker in perfect health, self-employed with a net profit of £60,000 taking cover to age 65:

- Age banded cost: £20.65 per month – the monthly cost is predetermined to increase annually

Lifetime premium cost: £47,876.04 - Reviewable non-age banded cost: £38.70 per month – the insurer has the discretion to review your premium based on their claims and profitability

Lifetime premium cost: £unknown - Guaranteed non-age banded cost: £39.96 per month – the monthly cost for the entire life of the plan will always stay the same

Lifetime premium cost: £19,266.86.

As you can see, the cost difference is shocking. Even more so if you consider that you could invest the difference over your working life.

If we ignore inflation, the only premium above that will never change is the highest initial monthly cost, but clearly the cheapest policy when looked at the total cost over the plan lifetime.

The above are all based on full payment term plans – that is, they will not restrict the length of any claim, thus providing a potential claim value for most dentists in the millions.

Budget income protection plans:

These lower cost plans pay only a maximum of two-five years, depending on insurer. These products are offered by the same companies that offer full term cover.

These are plans that are newer to the market. They aim to plug a gap in income cover by providing a lower-cost alternative. This is on the proviso that some cover is better than none.

They are not designed for professionals and/or high earning individuals.

Associate or principal?

The difference between the two is an associate will lose all of their income if they cannot work. Whereas, a practice owner will not.

Ongoing income, much like sick pay, will impact how much you can claim.

Owners of larger practices especially, where a large part of income is from associates, will continue to earn a sizeable portion of their pre-sickness income even when not working. Especially if they can find an effective associate or locum to fill in.

Thus, you need to calculate the difference between your current earnings and a forecast of income that will continue if you cannot work.

If this step was overlooked when calculating the maximum sum of cover, you can be certain you are not correctly covered.

Shockingly, I have yet to speak with a practice owner who has income protection where this was calculated at all – suggesting a large number of practice owners in the UK are over-insured without realising.

Own occupation cover

This part is less an informative section, more a definitive statement: a dentist needs own occupation income protection.

Many other definitions exist with various insurers – suited occupation, any occupation, working tasks definition.

The bottom line is even though you have trained hard and long to be dentists, you may be told by an insurer that you have to find a different job. They will not pay because you can still work doing something.

Take cover with an insurer who will assess the claim purely on whether you can work as a clinical dentist.

It isn’t complicated to set up

This is not strictly the whole truth, as you have read. As one of the largest advisors of income protection in the UK, I have consulted providers of own occupation income protection to ensure they provide the best cover for dentists. VR Financial Solutions help hundreds of dentists to put the right cover in place each year.

It’s easy when you know how, it’s just not easy to know how.

The cost of cover will not be any different if you go directly to an insurer, or via a professional advisor. To me, this really eliminates the benefit in setting cover up yourself.

Furthermore, if you use an advisor, you have an element of protection. By dealing with a regulated professional, you have some recourse should you later determine you were misadvised.

But you must choose where you take your advice carefully as dentistry is a profession with tricky financial intricacies. The word ‘specialist’ is protected in the medical and healthcare fields, guarded vehemently by your regulators. Sadly, it is not in the financial sector.

Thus, we find the sector with many self proclaimed specialists and advisors who would like to work with the very valuable clients that dentists can be. Choose yours wisely as the consequence of getting it wrong are usually discovered too late.

For more information, visit vrfs.uk.