As Christie & Co releases its dental market review, we speak to Paul Graham about the outlook for dental practice values.

For those who aren’t aware, can you explain what the dental market review is?

The dental market review is based upon the information that Christie & Co gathered from the market.

It includes our transactional data for the practices that we’re selling, which range from single sites to large portfolios. It also includes our valuation service team, which provides formal RICS valuations.

Both of those two components combined assist with our consultancy team, which provides buy side and sell side due diligence, among many other things.

That created more than 100 million data points for concern. So, the review that we create tries to capture our whole market.

I know that can be difficult at times, but we wanted to focus on the single sites that we’re selling, the larger transactions in the marketplace and also just to see the general sentiment in the marketplace coming from operators, buyers and some of the testimonials from sellers as well.

Reading through the review, it seems positive. What do you think is so attractive about dentistry for investors at the moment?

I think it was definitely off the back of the trends that we’ve seen following the pandemic.

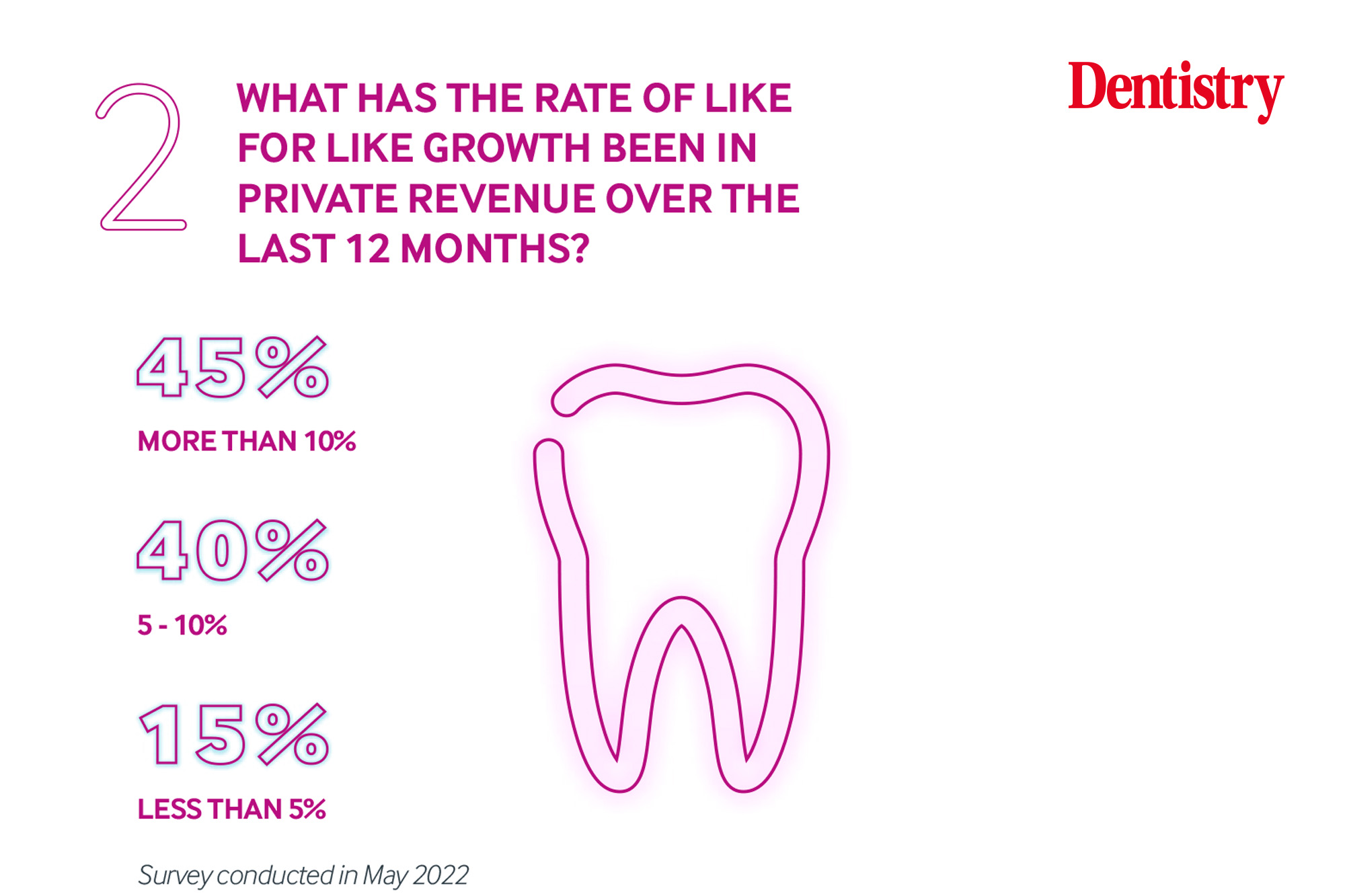

One of those trends that’s emerging is private dentistry – it is absolutely booming, and this is not necessarily because of NHS access issues.

In fact, far from it, because when we track those private practices that are performing very well just now, that’s not NHS treatments that they’re doing privately. Instead, it’s high-end cosmetic work and a direct result of what we’re doing now.

It’s the Zoom workers who are more aware of their appearances. Now they’ve not been on family holidays, so they have that disposable income. Accidental savers have money to spend on themselves.

Conversely, the NHS is getting a bit of an unfair bashing at the moment.

The core private market, yes, it’s very appealing, but it’s fantastic to see that the NHS market still has a stronghold of favourable investors.

The message can be mixed ever so slightly when we see those rallying for improvements in the NHS. The answer is simply that it’s not to remove the NHS, it’s to improve the framework.

Ever the optimist, but the changes have been rumbling on for a while and suggested changes might come to fruition over the next couple of years.

Those who are building small groups are therefore diversifying just now. They’re creating a broad range of core private practices, good mixed NHS practices, and solely NHS practices as well.

That will allow those portfolios to be agile and be in their best shape possible when there are any changes.

In the review, you report record levels of merger activity from the corporates. What do you feel is driving this activity and what does the activity look like?

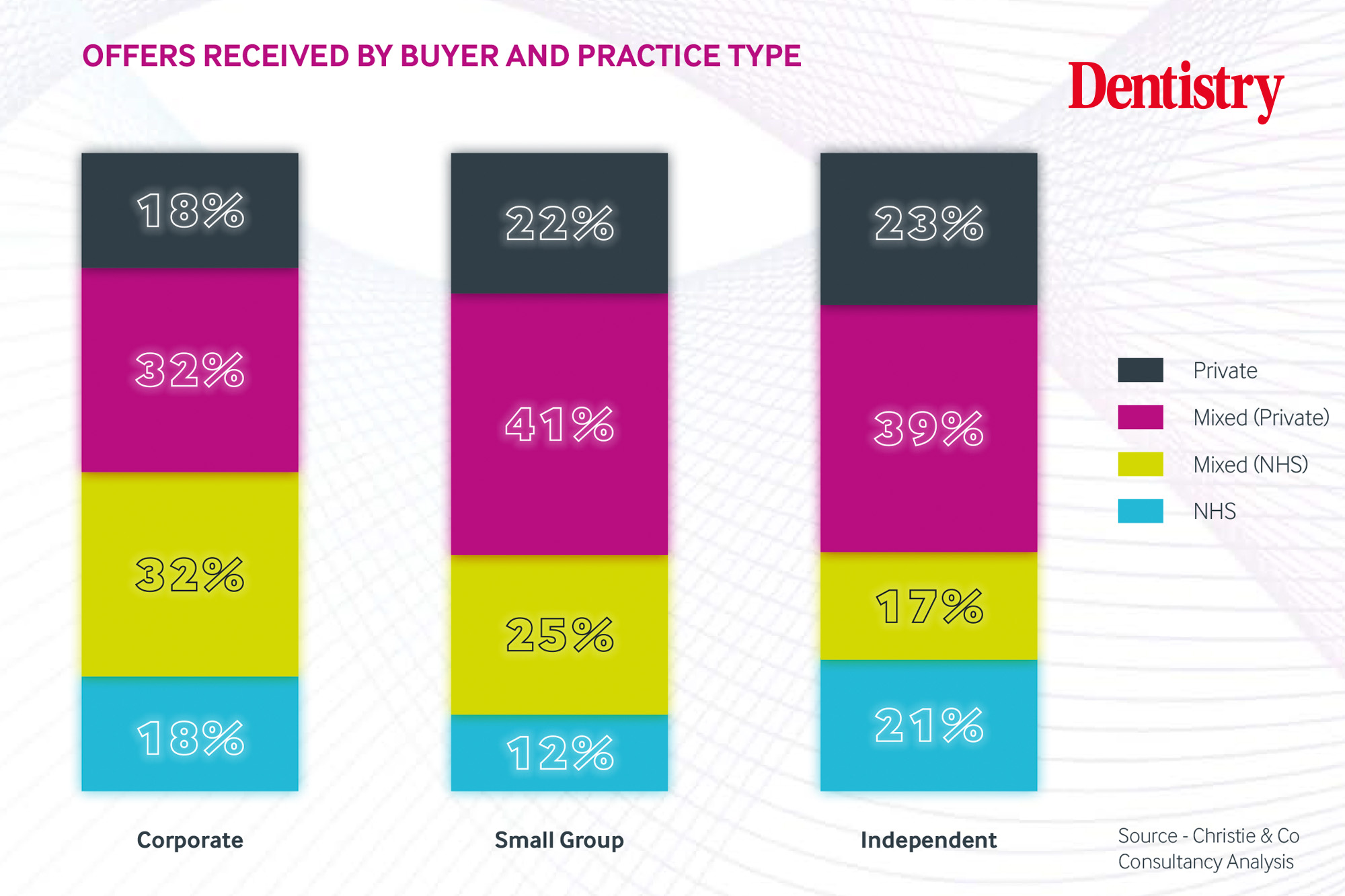

First of all, there’s a misconception in the marketplace that the majority of activity is coming from corporates now.

The positive trend that we see is independent operators that can range from first-time buyers to independent operators buying their second, third, fourth, fifth site.

This profile of buyers is really active in the marketplace and is pushing those boundaries quite considerably.

Corporate consolidation is happening at the top slice of the market and those tend to be practices of high quality and scale.

For practices that can support an associate-led model, the economies of scale work for them.

Arguably, there were fantastic practices pre-Covid-19 that have become better practices since, now that the operators have become more aware of the business of dentistry. They’ve been agile and adapted those businesses to be able to work in this current marketplace.

So, the corporate consolidation for those types of practices is really quite encouraging to see.

Again, in terms of the activity there, long gone are the days where we see what I would describe as a traditional vanilla trade deal or corporate deal. This is where a practice is valued at £1,000,000 and a corporate suggests they will pay £1,000,000 but defer 30% for a three-year period.

Usually there’s a turnover target for the seller to achieve, so the seller is tied in. And for every pound shortfall on turnover target, a pound is claimed back from the deferred amount. But that’s effectively a vendor-free loan they’re offering up – it’s not that exciting anymore.

Some of the deals we’re negotiating have upside rewards.

As the business improves and over performs, there are enhancements in that type of deal, there’s compounded interest on any deferred amount, or there’s an equity share in the business, for example.

This way, both the buyer and seller get the benefits of the sale and acquisition.

Do you see practice prices continuing to rise now that people are going back on holidays, for example?

It’s a question that we’ve been asking a lot of operators who are more aware of their own business and portfolio than ever before.

The clear message that’s coming from those operators is that this bubble is not going to burst. Private dentistry is here to stay.

Britain sits at the very bottom when it comes to average private dental spend per person.

So, I feel that when you look at or compare elsewhere in the world, there’s still scope for further growth.

While there’s a bit of flux in the NHS, yes, there’s now an enhancement in the private sector. But I think it will recalibrate.

Still, private dentistry and cosmetic dentistry are here to stay.

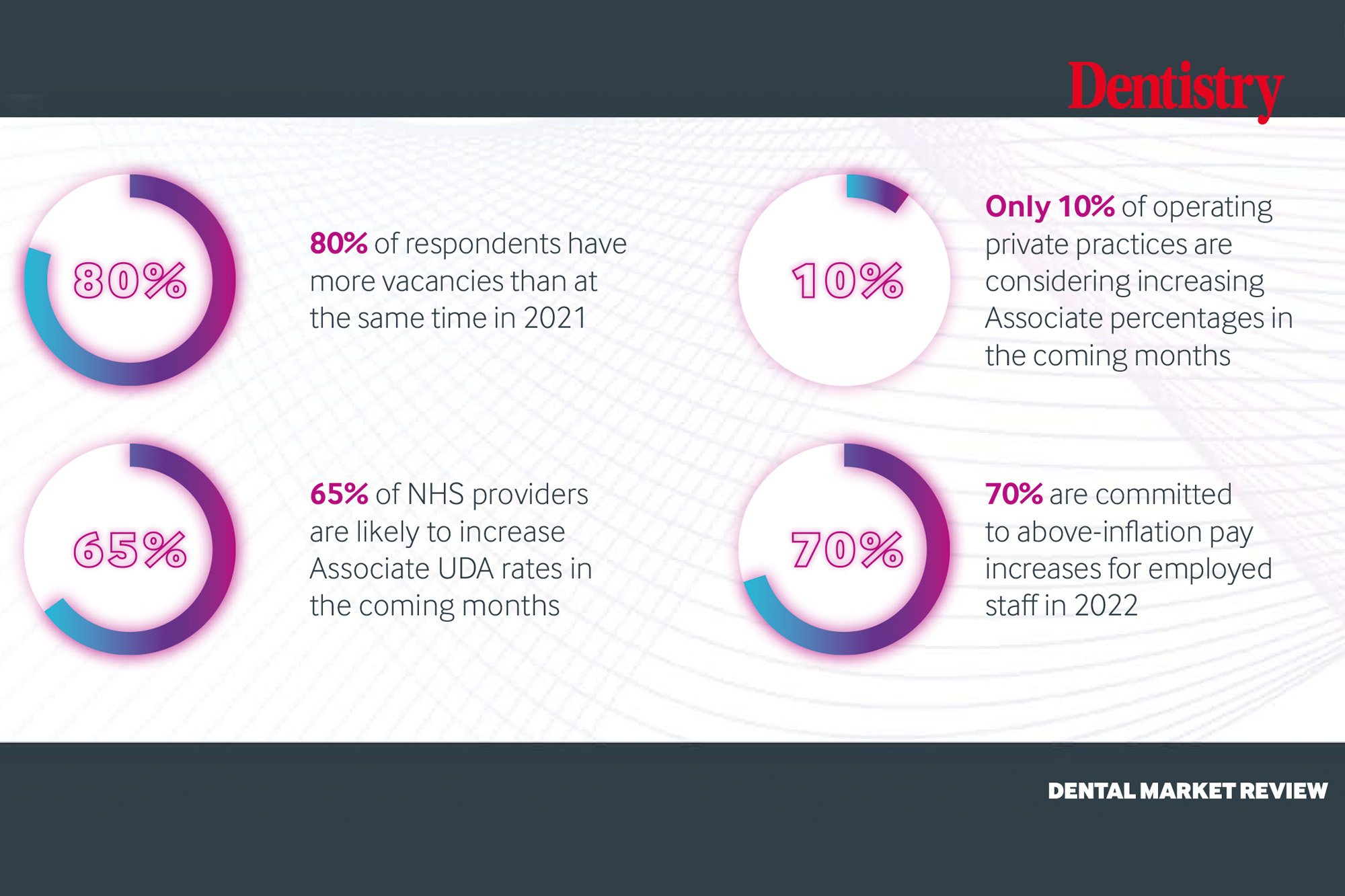

You also make a point of the recruitment crisis in the review. Do you feel like this can’t get any worse? Do you think this is a cause of concern for practices in the future as well?

I hope it doesn’t get any worse. That’s something that every sector is feeling just now.

There’s almost a kind of comfort that it’s not just applicable to the dental market.

It doesn’t feel as though it can get any worse, but I think, while there are so many of us talking about how we can improve this, it will create a rallying cry from operators.

There’s no crystal ball answer to how it’s going to be resolved, but I think our market is incredibly resilient at the moment.

These operators will adapt and make do as best as possible during this time. They’re surviving, and there’s very little impairment in the marketplace. But we hope that pressure comes off those operators soon.

We shouldn’t focus on the negatives, but if it doesn’t get any better, do you see it impacting practice values?

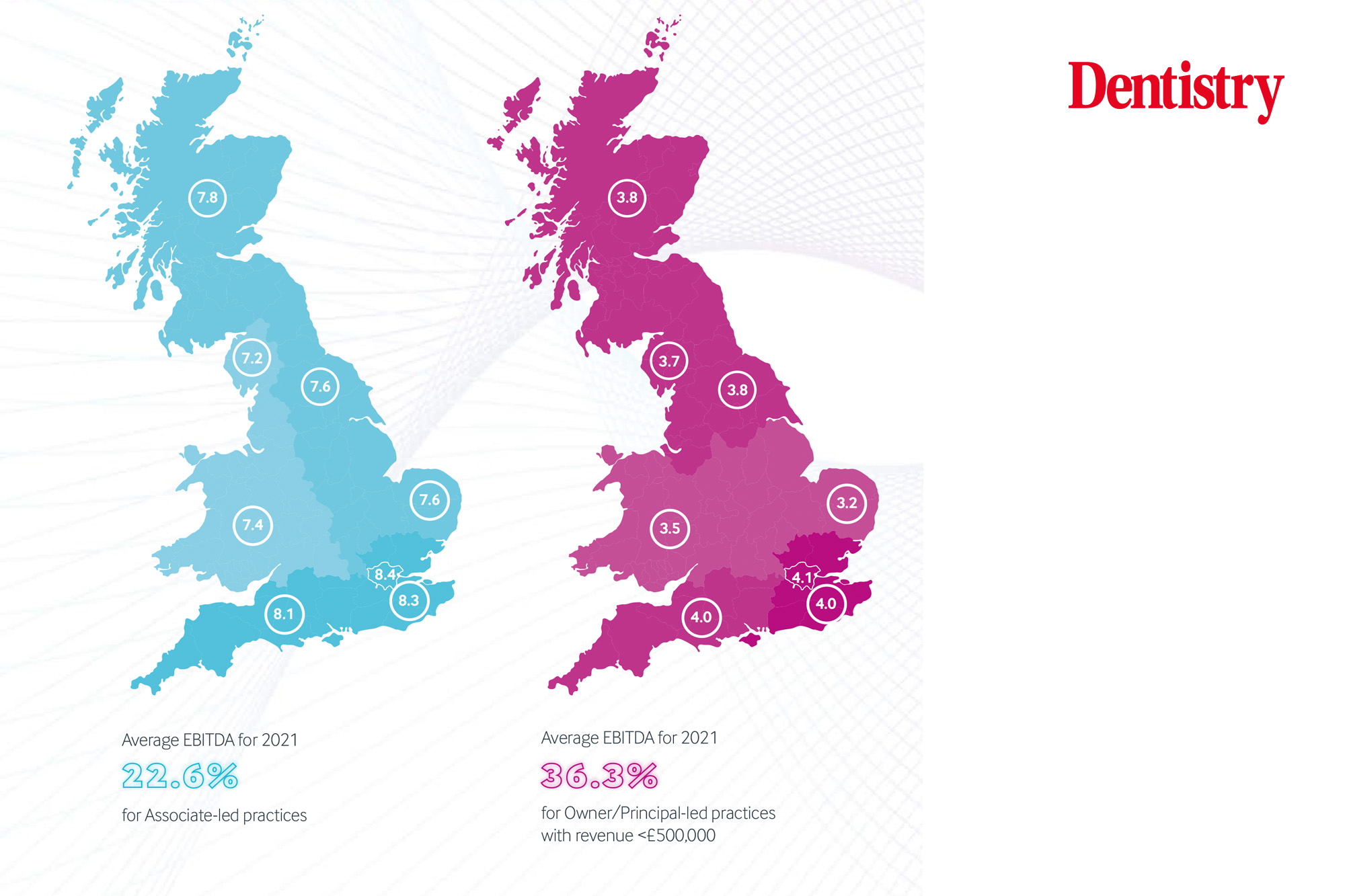

Yes, I think that, as a direct result, costs within a business will increase, so to attract staff and associates, pay scales may also increase.

So, while multiples and demand for practices will still be there, what we’re multiplying by might look different.

The average EBITDA multiple that’s achieved at the moment on a practice could stay the same, but the margin of EBITDA that we’re multiplying by might decrease.

The profit margin might go down as costs increase, and equally that’s along with the general cost of living, as well as lab costs, material costs, gas, and electricity all going up.

Movable expenses are just now starting to feel the pinch and there’s a squeeze on every cost that’s coming out of the business.

EBITDA multiples varied from region to region in the UK, but they were higher in the south of England. Why do you feel that area demands a higher EBITDA?

It comes down to recruitment and the opportunity there. The south east, particularly, is a hotspot of activity, so there’s demand there. And it’s generally perceived that recruitment is a little bit easier, versus more rural locations or coastal locations, for example.

Demand creates those multiples that we’re seeing now, and that’s why.

For anybody who wants to read the dental market review, where can they access it?

Directly from our website – www.christie.com/dentalreview2022.

If anyone is having difficulty there for any reason, they can contact me directly via email ([email protected]) and I’ll send a copy over.

For more information on the dental market review and to download a copy visit www.christie.com/dentalreview2022.

Follow Dentistry.co.uk on Instagram to keep up with all the latest dental news and trends.